Calculate reverse mortgage

It cant be expressed enough that you should almost always choose a 15-year fixed mortgage. Download our FREE Reverse Mortgage Amortization Calculator and edit future appreciation rates.

Mortgage Calculator Application App Development Companies Mobile App Development Companies Enterprise Application

Use our free mortgage calculator to estimate your monthly mortgage payments.

. Free Reverse Mortgage Calculator Calculate Now. 1 Can pay off existing mortgages on the home. This wont affect your payout but it.

Currently as of January 2022 the maximum claim for the Home Equity Conversion Mortgage HECM is 970800. How to Pay Off your Mortgage Faster. Call AAG at 800 224-9121.

To calculate the HECM credit line growth rate the initial interest rate IIR is added to the annual MIP rate. To estimate the equity calculate a fair price you feel the home is worth then subtract the loan balance. With a Reverse Mortgage you will never owe more than your homes value at the time the loan is repaid even if the Reverse Mortgage lenders have paid you more money than the value of the home.

This is a particularly useful advantage if you secure a. In the beginning a large portion of your payment goes to interest. If your loan balance is more than the value of your home your heirs wont have to pay more than 95 percent of the appraised value.

It usually comes in a line of credit paid to you by a lender. Account for interest rates and break down payments in an easy to use amortization schedule. It does not become due for as long as the homeowner lives in the property as their primary residence continues to pay required property taxes and insurance and maintains the home according to FHA.

For example if your initial interest rate is 350 and the. If you are shopping for the best reverse mortgage interest rate be sure to first compare the programs payment options explained in detail below. Mortgage calculator - calculate payments see amortization and compare loans.

See your reverse mortgage options. A reverse mortgage is a type of mortgage loan only available to homeowners aged 62 or older. If a home could be sold for 300000 and you have 150000 left on the loan you have 150000 in.

The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term. Pros of Reverse Mortgages. 40 cities that could be poised for a housing crisis.

The reverse mortgage amount that you could be eligible for is determined by several factors. How to Calculate Reverse Mortgage Amount. Find out how much money you can get based on home value equity age.

Dont forget to include your spouses age even if they are not yet 62 as loan proceeds are always based on the age of the youngest. These factors include but are not limited to the homeowners age property location home type and the appraised value of your home. Retire better with an AAG reverse mortgage loan designed to help seniors 62 and older leverage their home equity to supplement their retirement income.

Mortgage rates pulled back this week but economic uncertainty continues to keep price-struck buyers at bay. Calculate your loan estimate. In Step 2 we will ask you to provide information about your property.

Request your free estimate today. Across the United States 88 of home buyers finance their purchases with a mortgage. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan.

If you have a variable rate it can change over time. The reverse mortgage maximum claim is the cap on the value that can be used to calculate your principal limit. You have a home valued at 600000 and you are approved for a CHIP Reverse Mortgage of 150000.

How to Get the Best Interest Rate. The MoneyGeek Reverse Mortgage Calculator shows how much equity you can get from your home. A HECM is different from all other types of mortgages.

If you decide to proceed you will have a choice of reverse mortgage interest rate terms. This calculator has a years before sell setting which is used to run both loans from present until that dateIf you do not plan on selling the home refinancing again at a later date or moving out until after the loan is paid off then set this figure to 30 years so it compares both scenarios after all payments have been made. Read More Conquer the real estate market.

FHA reverse mortgages can charge a maximum of the greater of 2500 or 2 of the maximum mortgage claim amount of 200000 1 of any amount above that. Instead a reverse mortgage is the opposite of a traditional mortgage. Remember the amount we lend depends on several factors such as your age home value and location.

An AAG specialist can calculate your exact fees and rates based on the loan options you choose. As time progresses more is placed toward principal but it takes years before the interest and principal are equal paid. Also Reverse Mortgage Lenders have no claim on your income or other assets.

By entering these basic details you can find out how much money you could. Note that the expected rate is used just to calculate your loan amount or monthly payment. But our home affordability calculator will help you calculate a budget that will work for you.

Unless you plan to move in a few years the 15-year is the way to go. Taking a reverse mortgage is a popular financial strategy that helps generate more income during retirement. Negative points which are also referred to as rebate points or lender credits are the opposite of.

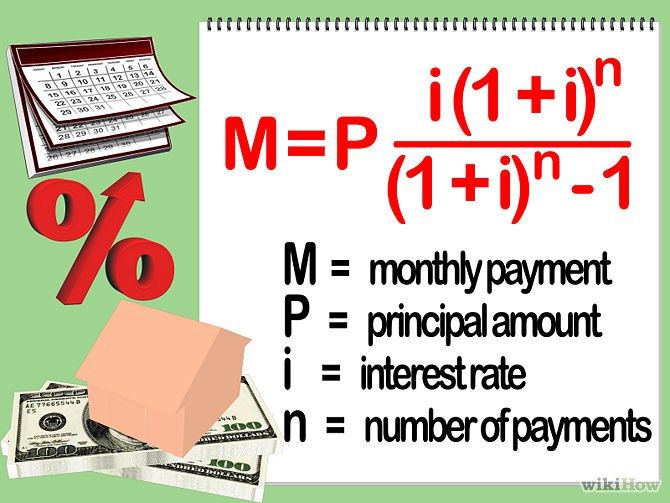

The remaining balance of the loan is covered by mortgage insurance. In just 4 simple steps this free mortgage calculator will show you your monthly mortgage payment and produce a complete payment-by-payment mortgage amortization schedule. This information only applies to Home Equity Conversion Mortgages HECMs which are the most common type of reverse mortgage loan.

Enter a few numbers and learn your reverse mortgage options. Example 1 5-year reverse mortgage interest rate term. Many prospects first gravitate to a fixed rate but find the mandatory lump sum unattractive when compared to the flexibility of a line of credit option or monthly payment plans featured on variable interest rate options.

Allows the homeowner to stay in the home. No monthly mortgage payments are required however the homeowner must live in the home as their primary residence continue to pay required property taxes homeowners insurance and maintain the home according to Federal Housing Administration. A reverse mortgage is a type of mortgage loan thats only available to senior homeownersages 62 and olderwho have plenty of home equity.

Free reverse mortgage calculator - instant estimate. Getting numbers on paper even estimates is a great way to gain an understanding of your options. Keys to Consider When Calculating Potential Refi Savings.

While people might find it confusing this is not at all a second mortgage which requires monthly payments. If you are within 6 months from your next birthday I will automatically calculate you a year older. You can also see the savings from prepaying your mortgage using 3 different methods.

When the loan is due and payable some or all of the equity in the property that is the subject of the reverse mortgage no longer belongs to borrowers who may need to sell the home or otherwise repay the loan. CHIP Reverse Mortgage from HomeEquity Bank is Canadas top provider of reverse mortgages. If your home is paid in full please select 0.

Here is how our reverse mortgage calculator works In Step 1 we will ask you to provide your age estimated home value and how much money you owe on your current home loan.

Responsive Home Loan Calculator Landing Page Home Loans Landing Page Design Mortgage Humor

Pin On Real Estate Tips News And Market Updates

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

Reverse Mortgages What To Know Visual Ly Reverse Mortgage Mortgage Info Mortgage Marketing

Reverse Mortgage Age Chart What Percentage Of Appraised Value Will I Get Reverse Mortgage Info Reverse Mortgage Refinance Mortgage Mortgage Calculator

Reverse Mortgage Reverse Mortgage Calculator Mortgage News Reverse Mortgage Mortgage Loan Originator Amortization Schedule

Reverse Mortgage Calculator Reverse Mortgage Pay Off Mortgage Early Mortgage Calculator

Idbi Bank Introduces Reverse Mortgage Loan For Senior Citizens It Seeks To Monetize The House As An Asset A Mortgage Loans Refinance Mortgage Reverse Mortgage

Reverse Mortgage Calculator Mls Mortgage Reverse Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator

Image Result For Equity Reverse Mortgage Home Equity Mortgage Amortization Calculator

Pros And Cons Of Getting A Reverse Mortgage Reverse Mortgage Refinancing Mortgage Mortgage Marketing

55 Brilliant Mortgage Direct Mail Postcard Advertising Examples Reverse Mortgage Mortgage Marketing Mortgage

You Ve Seen The Slick Commercials About How Great Reverse Mortgages Are But Are They Really All They Re Cracked Reverse Mortgage Invest Wisely Mortgage Humor

Common Questions About Reverse Mortgages Part 4 Reverse Mortgage Mortgage How To Get Money

The Essential Reverse Mortgage Factsheet Visual Ly Reverse Mortgage Mortgage Refinance Calculator Refinance Mortgage

New Reverse Mortgage Calculator Assess Your Suitability For This Loan Reverse Mortgage Mortgage Reverse

Infographic Anatomy Of A Reverse Mortgage Mortgage Infographic Reverse Mortgage Mortgage Payment Calculator

Komentar

Posting Komentar